COVID has irrevocably altered work habits, ushering in a new era of flexible work policies that were previously unthinkable. The evolution in how we work has had, and will have, tremendous implications for the real estate market, and in particular, within the Office sector.

Many of us have seen the dramatic shift in work habits first-hand, going from the 5-day in-person work weeks to a fully-remote work setup. Home prices in typically lower-cost suburban areas outpaced1 those in higher-cost urban areas as one could practically work from anywhere in the country. Since, a new normal has come forth in “hybrid” work setups providing workers with the flexibility they got accustomed to in recent years. Residential home values have remained robust2 since, despite sharp increases in mortgage rates.

Office real estate has been a completely different story, however. Remote work policies, combined with other challenges in some cities3, have kept workers from returning to downtowns. Office occupancy rates have recovered to only about 60%4 in major cities and businesses across the country currently occupy 200 million square feet ***less***5 than they did pre-COVID. Said another way, office vacancies are at a record high of about 20%6. And not just are vacancies up, but rents are also trending lower7.

In an asset class that is heavily reliant on debt, which is underwritten on typically high occupancy and rental rate assumptions, small negative developments in those factors (and thus cash flows) can have devastating implications for asset values. Such destructive forces have been on full display with office loan-defaults reaching historic levels8 and office building sales being recorded at drastically discounted valuations, often below the replacement value9.

Nervousness around the value of office real estate – typically financed with debt maturing in five to ten years – remains as a staggering amount of debt (over $200 billion in 2024 alone) comes due10 over the next few years in an interest rate environment that is materially higher than in years past. What this also suggests is that the timeframe for rebasing asset values may take longer to realize.

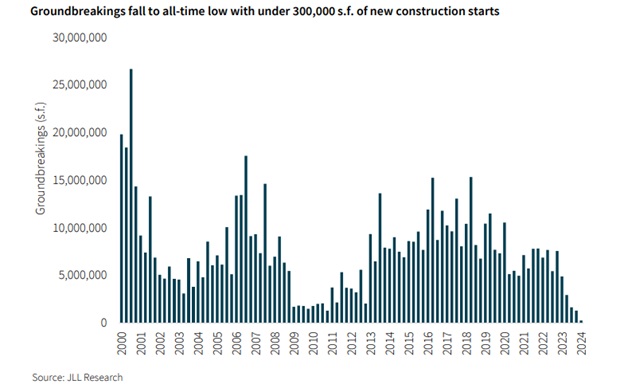

With distress comes opportunity, however. For starters, office occupancy rates, while still well below pre-COVID levels, are continuing to rise as more businesses increase the frequency of in-person work schedules. Challenging market conditions and scarcity of traditional financing are also heavily disincentivizing new office starts – the national office construction pipeline at the end of March was at an 11-year low, declining by 60% since 201911.

Further, office space owners or new acquirers are actively converting (to residential) or redeveloping office space to better meet market needs, helping further reduce office inventory. Finally, alternative investors, including the likes of Blackstone (who niftily avoided the office market over the last several years), are sitting on over $400 billion of dry-powder (or funds ready to be deployed) targeted for broad real estate assets. Given the dislocation in office valuations and the abovementioned factors, it would not be surprising to see some of these investors raise allocations to the office segment over time.

Capital markets have witnessed innumerable instances in which asset prices, once reset, lay the foundation for the next round of investment gains. However, similar to our firm’s investment focus on owning high-quality assets, buying high-quality real estate will be key to realizing such gains in the long-term. With that in mind, the current cycle of office price corrections could very well offer compelling long-term opportunity. To that end, we are *cautiously* evaluating hands-on office assets as well as office-centric private funds (being offered at material discounts to their net asset values) with the same discipline and rigor we apply to all our other investments.

3 Homelessness in US cities and downtowns - Brookings

4 Kastle Systems - Data Assisting in Return to Office Plans

5 Q1 2024 U.S. Office Real Estate Market Report - Our Insights - Plante Moran

6 Office Vacancy Rate Nears 20% to Set Fresh Record - CRE Daily

7 U.S. Office Rents Report April 2024 - CommercialEdge

8 Office-Loan Defaults Near Historic Levels With Billions on the Line (msn.com)

9 Real Estate Credit: Gear Up for the Year of Transactions - KKR

10 Some Distress Will Emerge Amid Wall of Loan Maturities - CBRE

11 U.S. Office Outlook (jll.com)